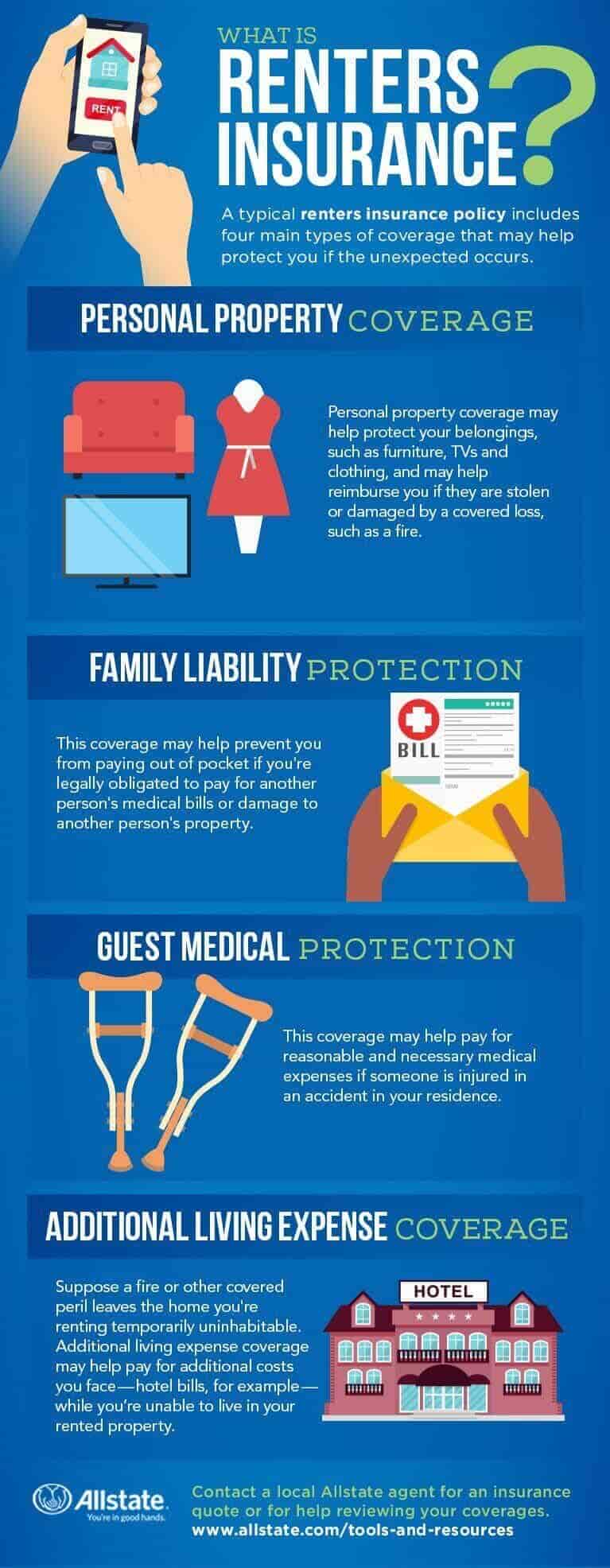

Tenants Insurance Coverage Vs Landlord Insurance: Insurance Coverage And Even More A mobile home occupants insurance policy also provides obligation insurance coverage. You could be sued if you mistakenly trigger injuries or eliminate somebody. Without renters insurance, you could be responsible for damages that may destroy you economically. All occupants-- regardless of the type of place you reside in-- need to take into consideration purchasing tenants insurance policy. While there are many reasons tenants select to rent without insurance coverage, one of the most common is that they are ignorant about what exactly renters insurance policy is and just how it helps them. As a property manager, aiding to educate prospective tenants concerning what all occupants insurance coverage covers will go a long means in searching for or producing a tenant ready to acquire tenants insurance policy. Liability protection might begin if a property manager is held liable for physical injury to a guest or tenant in their rental home. If something like a fire takes place at the property which causes the occupant to be not able to reside in the residential or commercial property, the renters insurance coverage would certainly provide them funding so they can remain somewhere else. When picking tenant's insurance coverage, make certain to choose a firm that works best for you. The initial will certainly pay to replace your 15-year-old carpeting, state, with Replacement cost coverage a brand-new one, at present market prices, while the second will only repay you for the value of a carpet that's 15 years old. The ordinary tenant's insurance coverage costs $15 to $30 a month in 2020, according to the National Organization of Insurance Policy Commissioners. Lots of occupants don't purchase renter's insurance policy, either since they don't think it is required or think they are covered under the property manager's policy. Also if you don't own a lot, it can quickly amount to a whole lot more than you realize; and a whole lot greater than you 'd want to pay to change whatever. High up on the listing is making sure that your personal possessions are covered, from your laptop to your bike or engagement ring. If your points get swiped, damaged, or destroyed, your property manager's insurance policy won't assist, yet an occupant's plan will. The ordinary national price for tenants insurance coverage is $125 each year, according to a Forbes Expert evaluation of occupants insurance policy prices. Here you can find details on how to transform homes while staying in Heka rental home. Surf brand-new fairly priced Heka rental houses and have a look at application durations. When you take out a home insurance policy from If you can feel confident that the cost of your insurance policy also stays low in the future. Every one of our deals are constant, and the price of your insurance will not sky-rocket after the initial year.

Commercial Landlord Insurance from £9.53 per month - Simply Business knowledge

Commercial Landlord Insurance from £9.53 per month.

Posted: Fri, 01 Aug 2014 04:32:01 GMT [source]

Pohjola Home Insurance Policy-- The Occupant's Insurance Coverage

Any kind of insurer that uses renters insurance coverage can supply a quote for mobile home tenants insurance protection. Before getting a tenants insurance coverage quote, identify how much personal effects and obligation insurance coverage you need, and pick a deductible. A proprietor's insurance policy does not cover your personal possessions, which is one reason why it is necessary to buy https://writeablog.net/cynhadgsrd/what-is-the-distinction-in-between-public-liability-and-general-liability occupants insurance coverage.5 Best Rental Property Insurance Companies of March 2024 - MarketWatch

5 Best Rental Property Insurance Companies of March 2024.

Posted: Tue, 20 Feb 2024 08:00:00 GMT [source]

What Are The Advantages Of Tenants Insurance?

Ultimately, these plans generally consist of liability and defense protection. These facets protect you as a private in case you wind up obtaining filed a claim against or asserted against for an event at the leasing. For example, the policy could offer the expense of your defense group if you are implicated of beginning a fire at the residential or commercial property with neglect. Property owner insurance policy is an insurance plan that is taken out by the property manager to cover the residential property itself.- You need a separate flooding insurance policy for that protection that you can purchase through the NFIP or a private insurance company.Having renters insurance offers the occupant comfort understanding they'll be financially covered if something occurs on the home.She specializes in travel, trainee financial debt and a number of other individual financing subjects.It supplies the very same protection that any type of tenants insurance coverage offers.For example, the plan may provide for the price of your protection group if you are accused of beginning a fire at the home through oversight.